Introduction Fintechzoom Apple Stock

Apple Inc. (AAPL) stands as one of the most influential and valuable companies in the technology sector. Known for its iconic products such as the iPhone, iPad, and Mac computers, Apple’s stock performance is closely watched by investors worldwide. This blog explores the current state of Apple’s stock, key factors influencing its performance, and how FintechZoom provides valuable insights into AAPL stock.

Overview of Apple Inc.

- Company Background:

- Apple Inc.: Founded in 1976 by Steve Jobs, Steve Wozniak, and Ronald Wayne, Apple has revolutionized consumer electronics with its innovative products and ecosystem. Headquartered in Cupertino, California, Apple continues to lead in design and technology, creating products that are both popular and highly profitable.

- Product Line: Apple’s flagship products include the iPhone, iPad, Mac computers, Apple Watch, and Apple TV. The company also offers services such as the App Store, Apple Music, iCloud, and Apple Pay, which contribute significantly to its revenue.

- Stock Performance:

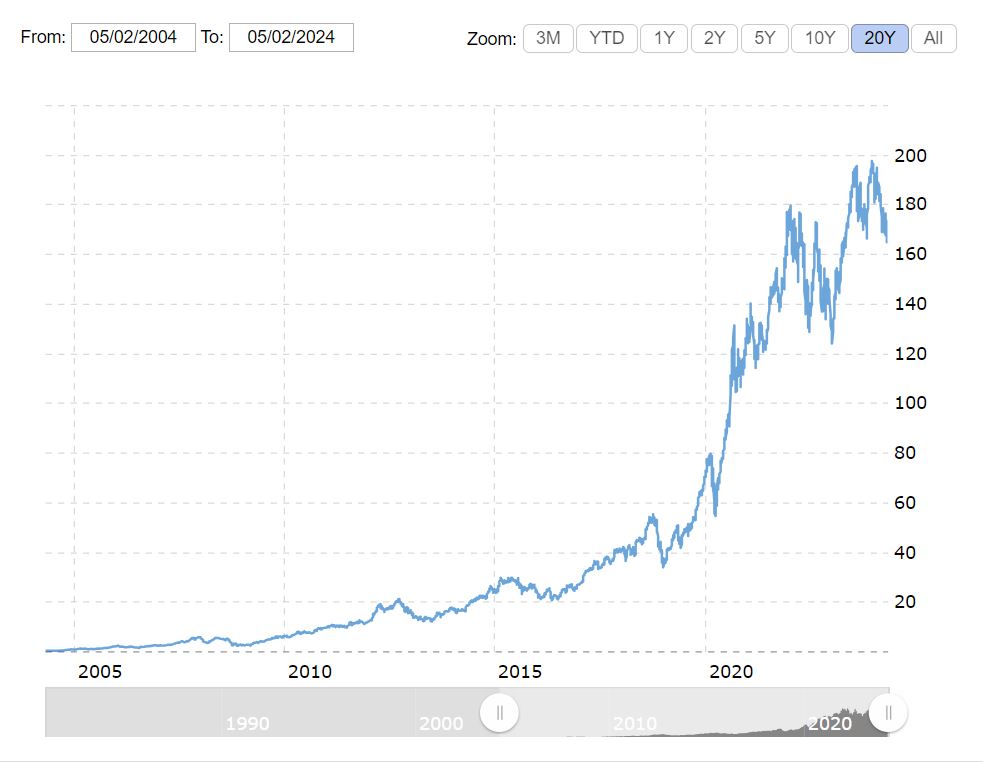

- Historical Performance: Apple’s stock has demonstrated strong performance over the years, with significant appreciation in value driven by its product innovation, brand strength, and financial performance. The stock has become a benchmark for the technology sector.

- Recent Trends: Apple’s stock performance is influenced by quarterly earnings, product announcements, and broader market conditions. Recent trends include fluctuations based on supply chain issues, product demand, and macroeconomic factors.

Analyzing AAPL Stock with FintechZoom

- Current Market Trends:

- Stock Performance: FintechZoom provides up-to-date information on Apple’s stock price, trading volume, and market capitalization. This real-time data helps investors track the stock’s current performance and make informed decisions.

- Technical Analysis: FintechZoom offers technical analysis tools that help investors evaluate Apple’s stock trends. Key indicators include moving averages, relative strength index (RSI), and other technical metrics that can signal potential buy or sell opportunities.

- Key Factors Influencing AAPL Stock:

- Company News: Apple’s stock price is affected by news related to product launches, technological advancements, and financial results. FintechZoom aggregates news and updates about Apple, providing a comprehensive view of factors impacting the stock.

- Earnings Reports: Quarterly earnings reports are crucial for Apple investors. These reports reveal key financial metrics such as revenue, earnings per share (EPS), and profit margins. FintechZoom provides detailed analysis and summaries of these reports to keep investors informed.

- Market Sentiment: Investor sentiment towards Apple can impact its stock price. Factors such as consumer demand for Apple’s products, competitive pressures, and macroeconomic trends play a role. FintechZoom tracks sentiment indicators and market commentary to offer insights into how these factors influence AAPL.

- Investment Strategies for Apple Stock:

- Research and Analysis: Conducting thorough research on Apple’s business model, financial health, and market conditions is essential. FintechZoom provides detailed reports and financial metrics to assist in this process.

- Diversification: While Apple is a leading tech company with significant growth potential, it’s important to diversify investments across different sectors and assets to manage risk. FintechZoom’s tools can help identify and analyze alternative investment opportunities.

- Long-Term vs. Short-Term: Investors should consider their investment horizon when dealing with Apple stock. Long-term investors may focus on Apple’s growth potential and technological advancements, while short-term traders might capitalize on market fluctuations. FintechZoom provides insights and analysis that cater to both investment strategies.

Risk Factors and Considerations

- Volatility: Apple’s stock, like many technology stocks, can be volatile. Investors should be prepared for potential price swings and consider how this volatility fits into their investment strategy.

- Competition: The technology sector is highly competitive, with numerous companies vying for market share. Apple’s ability to maintain its competitive edge through innovation and customer loyalty is a key factor to watch.

- Regulatory Environment: Changes in regulations related to technology, data privacy, and antitrust can impact Apple’s operations and stock performance. Staying informed about regulatory developments is crucial for understanding potential risks.

Apple’s Historical Stock Performance

Over the decades, Apple’s historical stock performance has demonstrated a remarkable trajectory marked by consistent growth and resilience in the face of market fluctuations. The Fintechzoom apple stock analysis reveals a decade-long trend of upward movement, showcasing Apple’s ability to weather market volatility.

Apple’s stock has been a notable performer, reflecting the company’s innovative products and strong financials. The consistent growth in Apple’s stock price has been influenced by various factors, including successful product launches, robust sales figures, and strategic business decisions.

Investors tracking Fintechzoom apple stock have witnessed the impact of Apple’s historical performance on market sentiment and investor confidence. The detailed earnings reports coverage has provided insights into the company’s financial health and future prospects, contributing to the overall positive trajectory of Apple’s stock.

As Apple continues to evolve and expand its product offerings and services, the historical stock performance serves as a confirmation to the company’s ability to deliver value to its shareholders amidst changing market dynamics.

Analyst Ratings and Target Prices

Continuing to assess Apple’s performance beyond historical trends, the current focus shifts towards analyzing Analyst Ratings and Target Prices for AAPL stock. Analyst Ratings play a vital role in guiding investors by providing insights into the potential future performance of a stock.

These ratings are often based on in-depth analysis of various factors, including company financials, market trends, and industry competition. Additionally, Target Prices offer a specific price level at which analysts believe the stock is fairly valued or should be traded in the future. Investors frequently consider these target prices when making decisions about buying, selling, or holding a stock like Apple.

Fintechzoom‘s apple stock price prediction section may contain a range of analyst ratings and corresponding target prices for AAPL stock. This data can be invaluable for investors seeking to make informed decisions based on expert opinions and market insights.

By incorporating these ratings and target prices into their investment strategies, individuals can better navigate the dynamic landscape of the stock market and potentially optimize their returns.

Decade-Long Stock Growth Analysis

Across the past decade, Apple’s stock has exhibited remarkable and sustained growth, reflecting the company’s consistent performance in the market. This growth can be attributed to several factors, including Apple’s ability to innovate and adapt to changing market conditions.

Despite facing challenges such as market volatility and competition, Apple has managed to maintain a steady upward trajectory in its stock value. The company’s focus on delivering high-quality products and services, coupled with its strong brand reputation, has contributed to investor confidence and loyalty over the years.

Other stock companies that want to stand firm in this market can also learn from Apple’s contribution to maintaining customer loyalty by providing high-quality products and services. For example, you can customize gifts for customers. Custom Pens is a good choice. Engrave the company’s logo and other information on the pen body, which not only improves customer satisfaction, but also increases brand awareness to a certain extent.

Furthermore, Apple’s strategic decisions, such as expanding into new markets and diversifying its product portfolio, have also played a significant role in driving stock growth. By consistently meeting or exceeding market expectations and demonstrating resilience in the face of economic uncertainties, Apple has established itself as a reliable investment option for many stakeholders. Moving forward, continued emphasis on innovation and customer-centric strategies will likely be key drivers of Apple’s stock growth in the years to come.

Impact of Product Launches

Amidst Apple’s sustained stock growth over the past decade, a pivotal factor influencing its market performance is the impact of new product launches on the company’s stock price. Apple’s stock price tends to react markedly to the introduction of new products, reflecting investor expectations and market sentiment surrounding these launches.

Historically, highly anticipated products like the iPhone, iPad, and Apple Watch have driven both consumer interest and investor confidence, leading to surges in stock value. Conversely, product launches that do not meet expectations or face challenges in the market can result in temporary dips in Apple’s stock price as investors reevaluate their positions.

Conclusion

Apple Inc.’s stock (AAPL) continues to be a focal point for investors due to its influential position in the technology sector and its consistent performance. FintechZoom offers valuable insights into AAPL stock through real-time data, technical analysis, and market sentiment indicators. By leveraging these resources, investors can make informed decisions, navigate the volatility of Apple’s stock, and align their investment strategies with their financial goals. Staying informed about Apple’s business developments and market trends is essential for successfully managing investments in this high-profile stock.